Causes, Strategies Of Calculating, And Examples

페이지 정보

본문

Depreciation is the reduction in the worth of a hard and fast asset as a result of utilization, wear and tear, the passage of time, or obsolescence. The loss on an asset that arises from depreciation is a direct consequence of the companies that the asset offers to its owner. Due to this fact, an affordable assumption is that the loss in the worth of a set asset in a period is the worth of the service supplied by that asset over that period. Just lately, we have now written three separate articles detailing tax planning strategies for numerous types of taxpayers. In this text, we’ve condensed all the things into a chunk-sized news piece. As the end of the financial yr approaches, strategic tax planning turns into crucial for all taxpayers. Whether or not you’re an individual, a property investor, or a small enterprise owner, understanding and implementing efficient tax methods can significantly scale back your tax burden and enhance your financial well being.

Lessees also prefer operating leases on account of their flexibility. It is commonplace for the lessee to have the ability to negotiate some of the terms and circumstances of the lease. Whether it's duration, interest charge, associated prices, or perhaps a deposit, lessors are often eager to help finance the equipment. Meaning evaluating every investment’s potential tax impact along with its threat/return profile and capacity to enhance a portfolio’s diversification. Dividend-paying stocks must be a element of most diversified portfolios, but we additionally want to hold nondividend-paying stocks to help maintain efficient diversification. That diversification is critical in helping a portfolio navigate a spread of markets, so it will possibly ship anticipated returns over the long term. Dividend revenue will help present a gentle element of returns, but it is taxed. We wish our clients to have control over their tax charges. Nonetheless, renewal or extension choices could also be obtainable, permitting continued use with out lengthy-time period commitment. The principal portion is a financing activity. The curiosity portion is an operating exercise. This separation provides a transparent view of money flows tied to lease obligations. Operating lease funds are categorized as working cash outflows, aligning with different business bills. The asset is essential for long-time period operations. Possession provides monetary or operational advantages. Tax advantages, comparable to depreciation, are a precedence. Brief-time period or flexible asset needs. Businesses looking for to reduce lengthy-time period commitments.

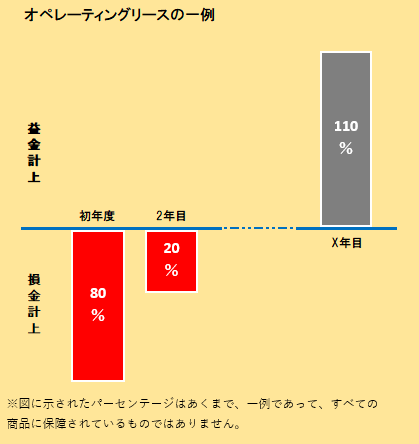

The interior Revenue Service (IRS) tax code is stuffed with legal methods for prime-income People to pay much less in taxes. Taking a proactive tax-planning approach can enable you decrease your taxes each right now and sooner or later. Making the utmost contributions each year to your retirement account is one of the most typical methods to reduce your taxes annually. Since it’s used to cut back the value of the asset, accumulated depreciation is a credit. Is depreciation a set price? Depreciation is a set price using many of the depreciation methods, since the quantity is ready each year, regardless of whether or not the business’ exercise ranges change. The exception is the units of production methodology. Underneath this technique, オペレーティングリース リスク the more models your business produces (or the extra hours the asset is in use), the upper your depreciation expense shall be. It may be extra beneficial for the corporate to lease the necessary equipment or machinery for certain quick-time period industrial tasks moderately than purchasing costly equipment outright. An working lease is suitable for enterprise owners who could also be looking for to finance a short or long-term lease agreement that will probably be utilized to fulfill enterprise operations. There are a lot of benefits a enterprise can acquire, from both a value-benefit and responsibility perspective.

From managing tremendous contributions and prepaying bills to understanding the intricacies of investment property deductions and enterprise tax methods, every motion you're taking could make a substantial difference. As you navigate the financial challenges and alternatives of 2024, proactive tax planning can offer you the financial stability and foresight wanted for long-term success. At Investax Group, we perceive that every taxpayer’s scenario is exclusive, and we are dedicated to providing tailor-made advice that aligns with your particular wants. Regardless that the airline industry is rising as fast as ever, there are dangers associated to the leasing business. While demand won't drop off drastically and can probably keep rising, the quantity of leasing companies has additionally risen massively. According to Boeing’s market outlook for 2019, in 2002 there were less than a hundred leasing firms providing their companies to airways.

- 이전글Sports Betting Picks For Sports Bettors 24.12.28

- 다음글The Dynamics and Insights of Weekend Bar Shifts 24.12.28

댓글목록

등록된 댓글이 없습니다.